Columns By Category

Popular Articles

- THE REALITY OF TACKY AND SAM SHARPE

- PLEASE DON’T BETRAY US AGAIN POLITICIANS

- CRY, MY MURDEROUS COUNTRY

- MODERNIZING THE PNP: VERSION.2020

- IS THE EXCHANGE RATE ON TARGET OR IS IT A WHOPPER?

- CARICOM: BEACON OF DEMOCRACY OR COWARDLY DISGRACE?

- DEMOCRACY PREVAILS IN THE UNITED STATES

- THE CRIME STATISTICS SPEAK FOR THEMSELVES

- PETROJAM, OIL PRICES, AND THE $7 TAX

- Kevin O'Brien Chang | Brains, not brutality – smart(phone) crime fighting

- TERRORISM IN JAMAICA

- STOP CURRENCY CRISIS TALK

- 'CASTIGATED KD' AND THE 9 YEAR WONDER

- GET PAST MERE TALK ON DONS AND GARRISONS

- LOW VOTER TURNOUT MYTHS AND ELECTION PREDICTIONS

- HOW GREAT CAN BROGAD BE?

- PNP WAS SOCIALIST FROM THE START

- AN AGE AND GENDER RE-ALIGNMENT ELECTION?

- Most influential Jamaican of 2010-2019?

- NO GAYLE, NO RUSSELL, NO TALLAWAHS

VALUING THE J$ BY PPP AND BIG MAC

- 5-11-2003

- Categorized in: 2003 Articles, Jamaica, Politics, World Affairs

Since December the Jamaican dollar has slid from about 48 to over 60 to one against its US counterpart. Where it will settle is anyone’s guess, but perhaps the past can give some guide as to what is to come.

The standard economic tool for valuing a currency is the Purchasing Power Parity theory. This states that exchange rates between two currencies are in equilibrium when their purchasing power is the same in both countries. So the J$ rate should equal the price of a fixed basket of goods and services in Jamaica divided by the price in the USA.

If two currencies begin in equilibrium, the rate of appreciation of one against the other should equal the difference in inflation rates between the two countries. For example, if Jamaica’s inflation rate is 3% and the US’s is 1%, the J$ should depreciate against the US$ by 2% per year.

PPP does not always hold in the short run as factors like expectations of growth, inflation and interest rates can drive exchange rates in the near term. But the economic forces behind PPP will eventually equalize the purchasing power of currencies, though this can take many years. A typical time horizon is 4-10 years.

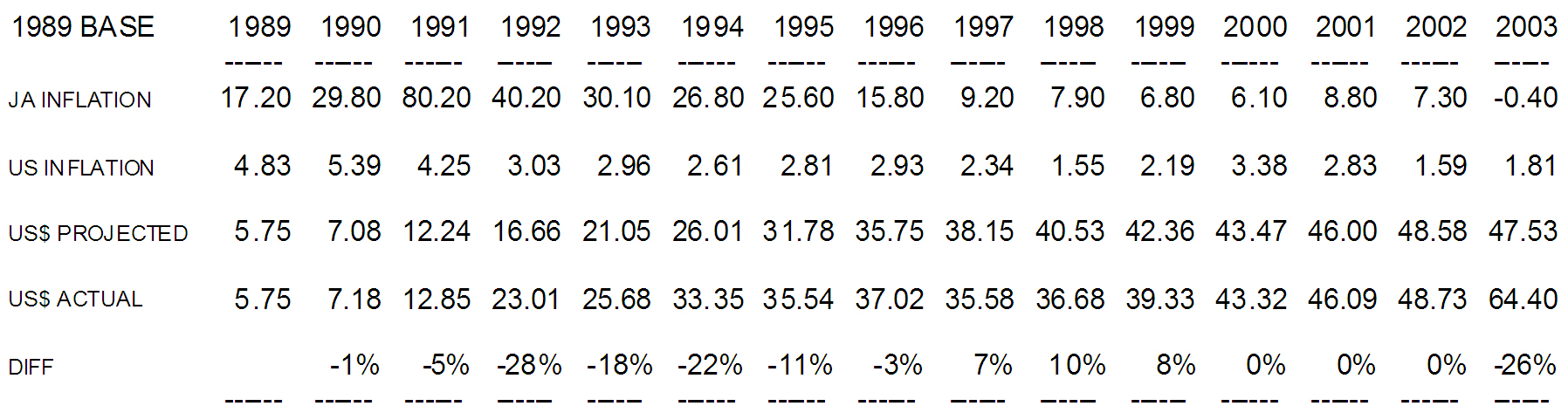

Below are a table and chart showing PPP projections of the J$ rate versus actual rates using 1989 as the base year.

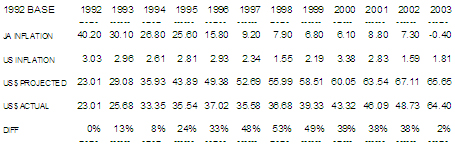

If 1992 is used as the base year however things look quite different.

So if the J$ was correctly valued in 1989 its correct PPP value against the US$ would now be about 48 to 1. On the other hand – Oh for a one armed economist! - if the J$ was correctly valued in 1992, then its correct PPP value is now about 65 to 1.

Now these figures show the J$ and US$ in isolation. The Economist magazine’s ‘Big Mac’ hamburger index gives an international view. To quote

“… in the long run, exchange rates should move toward rates that equalise the prices of an identical basket of goods and services in any two countries. To put it simply: one US dollar should buy the same everywhere. Our basket is a McDonald's Big Mac, produced locally to roughly the same recipe in 118 countries. The Big Mac PPP is the exchange rate that would leave burgers costing the same as in America. Comparing the PPP with the actual rate is one test of whether a currency is undervalued or overvalued.”

In her book ‘The Big Mac Index’ Li Lian Ong of the IMF says it has been surprisingly accurate in tracking exchange rates in the long term. However emerging-market currencies are consistently undervalued.

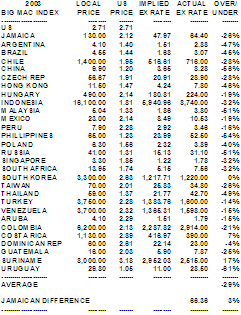

Here is a developing country Big Mac index using the Economist’s April 26th website figures and current Jamaican numbers. The first column shows local-currency prices of a Big Mac. The second converts them into dollars. Dividing the local-currency price by the actual US Big Mac price of $2.71 gives the implied exchange rate. Dividing the implied exchange rate by the actual exchange rate gives the over / under figure.

According to the Big Mac index then, the J$ is now undervalued by 26% and should be about 48 to one. However these 29 currencies are on average undervalued by 29%. So compared to other developing countries, the J$ is overvalued by 3% and should theoretically be about 65 to one.

Some say Jamaica is a third world country and so should compare its exchange rate with other developing countries’. Others argue that since our informal economy as a percentage of GDP is one of the biggest in the world and is largely conducted in American dollars, the unadjusted Big Mac figure will likely be more accurate.

Certainly remittances and illegal drugs seriously distort Jamaica’s labour market, especially for young males. Just last week a friend in the car business moaned to me that that he couldn’t find young men willing to work - apparently readily available ‘barrel and runnings’ money meant what he was offering wasn’t worth their while. He’s actually now thinking of importing Cuban labour.

All of this ignores Jamaica’s ever growing debt burden and the government’s continuing fiscal irresponsibility. Maybe the J$’s sharp decline against the US$ – and it has fallen even more precipitously against the Euro - reflects the market’s feeling that Omar Davis’ sums do not add up.

But if – and it’s getting to be a bigger if every year - our dangerous deficits do not cause an Argentine style economic explosion, PPP theory and the Big Mac Index imply that in the current conditions the true value of the J$ against the US$ is somewhere between 48 and 65.

Of course the past merely shows what has happened and not what is to come. As Sam Goldwyn once said - “I never make predictions, especially about the future”. changkob@hotmail.com