Columns By Category

Popular Articles

- THE REALITY OF TACKY AND SAM SHARPE

- PLEASE DON’T BETRAY US AGAIN POLITICIANS

- CRY, MY MURDEROUS COUNTRY

- MODERNIZING THE PNP: VERSION.2020

- IS THE EXCHANGE RATE ON TARGET OR IS IT A WHOPPER?

- CARICOM: BEACON OF DEMOCRACY OR COWARDLY DISGRACE?

- DEMOCRACY PREVAILS IN THE UNITED STATES

- THE CRIME STATISTICS SPEAK FOR THEMSELVES

- PETROJAM, OIL PRICES, AND THE $7 TAX

- Kevin O'Brien Chang | Brains, not brutality – smart(phone) crime fighting

- TERRORISM IN JAMAICA

- STOP CURRENCY CRISIS TALK

- 'CASTIGATED KD' AND THE 9 YEAR WONDER

- GET PAST MERE TALK ON DONS AND GARRISONS

- LOW VOTER TURNOUT MYTHS AND ELECTION PREDICTIONS

- HOW GREAT CAN BROGAD BE?

- PNP WAS SOCIALIST FROM THE START

- AN AGE AND GENDER RE-ALIGNMENT ELECTION?

- Most influential Jamaican of 2010-2019?

- NO GAYLE, NO RUSSELL, NO TALLAWAHS

PETROJAM, OIL PRICES, AND THE $7 TAX

- 5-16-2016

- Categorized in: 2016 Articles, Yearly ARCHIVES

Like most Jamaicans I have been very puzzled at the lack of correlation between the fluctuation of the price of oil on international markets and the price we Jamaicans pay for petrol at gas stations.

Having repeatedly called in vain for some clarity from both the present JLP administration and the previous PNP administration, I decided to do some investigation of my own.

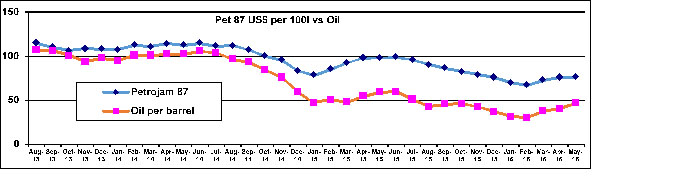

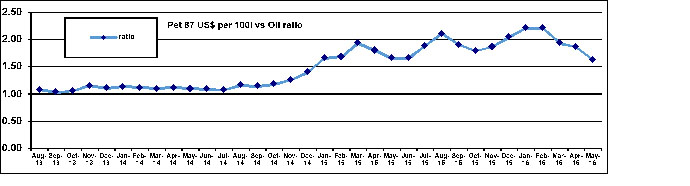

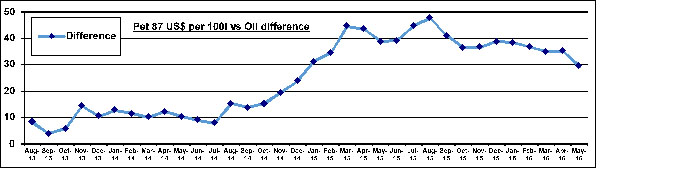

I simply compared the price of 87 gas on the Petrojam website to world oil prices from August 2013 to May 2016.

Here are the two websites used.

http://www.petrojam.com/price-index?field_price_date_value%5Bvalue%5D%5Byear%5D=2013

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=rwtc&f=M

(Now I am not a professional economist and perhaps our professors and analysts will have access to better data and more accurate calculations. But hopefully this will start a much needed public debate on the topic.)

|

DATE |

Petrojam 87 |

Petrojam 87 |

Petrojam 87 |

Oil per barrel |

ratio |

Difference |

|||

|

$JA per litre |

US$ per litre |

US$ per litre 100 |

US$ |

US$ |

|||||

|

Aug-13 |

117 |

102 |

1.15 |

115 |

107 |

1.08 |

8 |

||

|

Sep-13 |

113 |

103 |

1.10 |

110 |

106 |

1.04 |

4 |

||

|

Oct-13 |

111 |

105 |

1.06 |

106 |

101 |

1.06 |

6 |

||

|

Nov-13 |

114 |

105 |

1.08 |

108 |

94 |

1.15 |

14 |

||

|

Dec-13 |

115 |

106 |

1.08 |

108 |

98 |

1.11 |

10 |

||

|

Jan-14 |

115 |

107 |

1.07 |

107 |

95 |

1.13 |

13 |

||

|

Feb-14 |

121 |

108 |

1.12 |

112 |

101 |

1.11 |

11 |

||

|

Mar-14 |

121 |

109 |

1.11 |

111 |

101 |

1.10 |

10 |

||

|

Apr-14 |

126 |

110 |

1.14 |

114 |

102 |

1.12 |

12 |

||

|

May-14 |

125 |

111 |

1.13 |

113 |

102 |

1.10 |

10 |

||

|

Jun-14 |

128 |

112 |

1.15 |

115 |

106 |

1.08 |

9 |

||

|

Jul-14 |

125 |

113 |

1.11 |

111 |

104 |

1.08 |

8 |

||

|

Aug-14 |

126 |

113 |

1.12 |

112 |

97 |

1.16 |

15 |

||

|

Sep-14 |

121 |

113 |

1.07 |

107 |

93 |

1.15 |

14 |

||

|

Oct-14 |

112 |

113 |

1.00 |

100 |

84 |

1.18 |

15 |

||

|

Nov-14 |

108 |

113 |

0.95 |

95 |

76 |

1.26 |

19 |

||

|

Dec-14 |

95 |

114 |

0.83 |

83 |

59 |

1.40 |

24 |

||

|

Jan-15 |

90 |

115 |

0.78 |

78 |

47 |

1.66 |

31 |

||

|

Feb-15 |

98 |

115 |

0.85 |

85 |

51 |

1.68 |

35 |

||

|

Mar-15 |

107 |

115 |

0.92 |

92 |

48 |

1.93 |

45 |

||

|

Apr-15 |

113 |

116 |

0.98 |

98 |

54 |

1.80 |

43 |

||

|

May-15 |

114 |

116 |

0.98 |

98 |

59 |

1.65 |

39 |

||

|

Jun-15 |

115 |

117 |

0.99 |

99 |

60 |

1.65 |

39 |

||

|

Jul-15 |

112 |

117 |

0.96 |

96 |

51 |

1.88 |

45 |

||

|

Aug-15 |

106 |

118 |

0.90 |

90 |

43 |

2.11 |

48 |

||

|

Sep-15 |

103 |

119 |

0.86 |

86 |

45 |

1.90 |

41 |

||

|

Oct-15 |

99 |

120 |

0.83 |

83 |

46 |

1.79 |

36 |

||

|

Nov-15 |

95 |

120 |

0.79 |

79 |

42 |

1.86 |

37 |

||

|

Dec-15 |

91 |

120 |

0.76 |

76 |

37 |

2.04 |

39 |

||

|

Jan-16 |

85 |

121 |

0.70 |

70 |

32 |

2.21 |

38 |

||

|

Feb-16 |

82 |

122 |

0.67 |

67 |

30 |

2.21 |

37 |

||

|

Mar-16 |

88 |

122 |

0.73 |

73 |

38 |

1.93 |

35 |

||

|

Apr-16 |

93 |

122 |

0.76 |

76 |

41 |

1.86 |

35 |

||

|

12-May-16 |

94 |

123 |

0.76 |

76 |

47 |

1.63 |

29 |

||

|

13-May-16 |

101 |

123 |

0.82 |

82 |

47 |

1.76 |

36 |

First off, this chart shows that the Petrojam price for 87 gas in May 2015 was JA $114 or US $0.98.

As of May 12 2016 the price was JA $94 or US $0.76.

As of May 13 2016, after the addition of the $7 tax imposed by the government, the price was JA $101 or US $0.82.

So even after the imposition of the $7 tax, the Petrojam price of 87 gas is substantially lower than it was a year ago in both JA$ and US$.

Incidentally in August 2013, the last time taxi drivers got a rate increase if memory serves me right, the Petrojam price of 87 gas was JA $117 or US $1.15.

Again this is substantially higher than the current after tax rate of JA $101 or US $0.82.

|

DATE |

Petrojam 87 |

Petrojam 87 |

|

|

$JA per litre |

US$ per litre |

||

|

Aug-13 |

117 |

102 |

1.15 |

|

May-15 |

114 |

116 |

0.98 |

|

12-May-16 |

94 |

123 |

0.76 |

|

plus $7 |

|||

|

13-May-16 |

101 |

123 |

0.82 |

To investigate more closely the correlation between price movements of petrojam 87 gas prices and world oil prices I have done three charts comparing the price of 100 litres of Petrojam 87 gas versus oil prices from August 2013 to May 2016.

In August 2013 the price of 100 litres of Petrojam 87 gas was US$ 115. The price of a barrel of oil was US$107. A difference of US$8 and a ratio of 1.08.

On May 12 2016 (before the $7 tax increase) the price of 100 litres of Petrojam 87 gas was US$ 82. The price of a barrel of oil was US$47. A difference of US$35 and a ratio of 1.63.

Here are three charts showing the movement over time.

We the public are certainly owed an explanation from Petrojam and the government as to why there has been such a dramatic divergence.

Indeed I am calling on the present administration to make fully public exactly how Petrojam arrives at the prices it charges. Surely it must be based primarily on the price of oil on world markets. But there seems to be little consistency between the two.

We have been told that the country saved nearly one billion US dollars on oil imports last year. This is between 6% and 7% of our GDP. But how exactly did this savings flow through our economy?

Furthermore what goes down can go up. There is no guarantee that oil prices will not shoot up as dramatically as they have plummeted. No one really has a clue where oil prices will be next month much less next year. As Kelly Tomblin joked recently, JPS has three oil consultants – one says prices will go up, one says prices will go down, one says prices will stay the same. What we do know is that prices can swing suddenly. On February 25 oil was about $30. As of yesterday it was $47, an increase of over 50%.

So the government needs to tell us what oil price assumptions were used in casting its tax plan. When Audley Shaw says they are continuing the hedge, what exactly does he mean? At what price and for how long?

Obviously oil prices are something the government cannot control. But if oil shoots up and electricity and gas prices sky rocket, you better believe they are going to get the blame. And all this talk about prosperity and growth will then seem a cruel joke. Common sense says they should at least educate the public about all possibilities. So if the worst scenario does take place, at least our minds will be prepared.

Oil has always been a worldwide source of hidden machinations and corruption. Not for nothing is it nicknamed the devil’s excrement. If the Andrew Holness’ administration cannot give us the full details about Jamaica’s single biggest import item and the one that has the greatest impact on inflation and our trade deficit, how can we possibly take seriously his repeated protestations that he is ‘different’ and fully committed to transparency and accountability?