Columns By Category

Popular Articles

- THE REALITY OF TACKY AND SAM SHARPE

- PLEASE DON’T BETRAY US AGAIN POLITICIANS

- CRY, MY MURDEROUS COUNTRY

- MODERNIZING THE PNP: VERSION.2020

- IS THE EXCHANGE RATE ON TARGET OR IS IT A WHOPPER?

- CARICOM: BEACON OF DEMOCRACY OR COWARDLY DISGRACE?

- DEMOCRACY PREVAILS IN THE UNITED STATES

- THE CRIME STATISTICS SPEAK FOR THEMSELVES

- PETROJAM, OIL PRICES, AND THE $7 TAX

- Kevin O'Brien Chang | Brains, not brutality – smart(phone) crime fighting

- TERRORISM IN JAMAICA

- STOP CURRENCY CRISIS TALK

- 'CASTIGATED KD' AND THE 9 YEAR WONDER

- GET PAST MERE TALK ON DONS AND GARRISONS

- LOW VOTER TURNOUT MYTHS AND ELECTION PREDICTIONS

- HOW GREAT CAN BROGAD BE?

- PNP WAS SOCIALIST FROM THE START

- AN AGE AND GENDER RE-ALIGNMENT ELECTION?

- Most influential Jamaican of 2010-2019?

- NO GAYLE, NO RUSSELL, NO TALLAWAHS

STOP CURRENCY CRISIS TALK

- 11-12-2019

- Categorized in: 2019 Articles, Yearly ARCHIVES

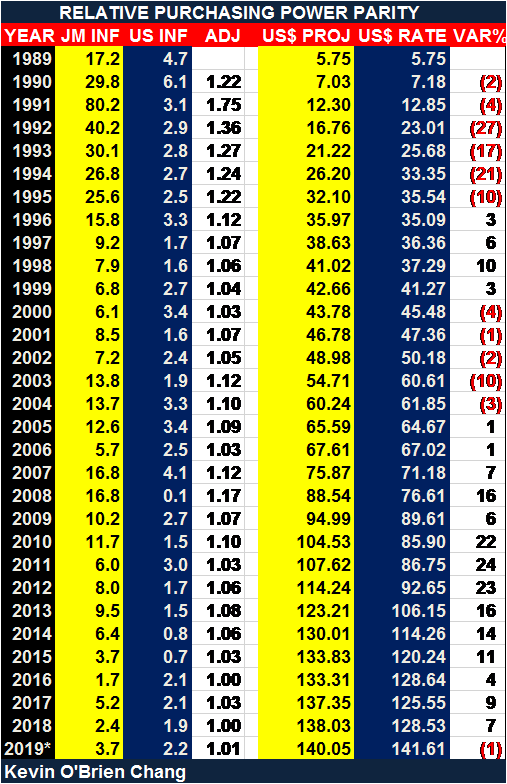

When I came back to Jamaica from school in Canada in 1989, the $JA:US rate was 5.75. By 1994 it was over 33, a 583% increase in 5 years. It is now 141, meaning a 2,452% increase over 30 years. Given this historical context, the five to ten percent fluctuations of recent years are hardly worth panicking about.

One basic component of Economics 101 is the Relative Purchasing Power Parity theory, which states that the real cost of a good should be the same in all countries. Hence differences in national inflation rates will be eventually be reflected in exchange rates, and countries with higher inflation will experience currency devaluation. So if Jamaica's inflation rate is 14 per cent and the US's is 3 per cent, the $JA should depreciate against the $US by 14% - 3% = 11%. Which actually has been roughly the average annual situation since 1989 – 11% inflation differential and 11% devaluation.

Purchasing Power Parity (PPP) does not always hold in the short run, but economic forces eventually equalise the purchasing power of currencies in the long run, a typical time horizon being 4-10 years.

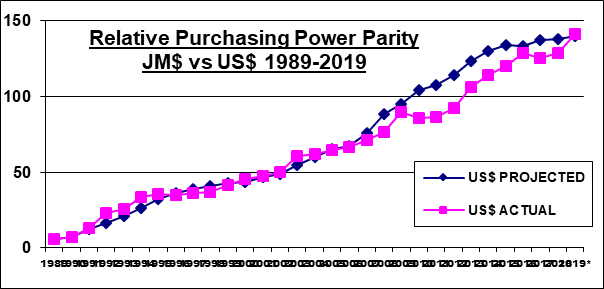

PPP has pretty accurately tracked the $JA:US rate since the Jamaican dollar floated in 1989, as the below table and graph show. Indeed the current predicted rate almost exactly matches the actual rate of 141.

(Here are two previous articles on PPP and the $JA:US rate. http://www.kevinobrienchang.com/articles/valuing-the-j-by-ppp-and-big-mac-.html

All the above is surely well known to BOJ head Richard Byles, PSOJ president Keith Duncan and Finance Minister Nigel Clarke. It’s hard to understand why these learned gentlemen have not jointly educated the public on these PPP realities, instead of letting the media alarm the public with misleading headlines about a ‘currency crisis’.

Most disappointing of all is Opposition Finance spokesman Mark Golding. http://www.loopjamaica.com/content/golding-lashes-govt-over-unstable-exchange-rate He must know economic theory taught at Oxford is totally at odds with the irresponsible, politically motivated nonsense he is spouting, which risks undermining the BOJ’s targeted inflation policy. How can a country progress when those who know better do not do better?

All exchange rates fluctuate normally in a 10% or so band. But barring some unforeseen inflation explosion as Jamaica witnessed in 1990-1996, or a severe exogenous shock like oil prices soaring, the $JA-$US is unlikely to go up or down very much outside what PPP predicts. Which right now is the 141 prevailing on the market.

We must presume the economic experts at the BOJ and IMF know why they consider inflation targeting of 4%-6% the optimum strategy for Jamaica. But they also must know that given an expected US inflation of roughly 2%, we can expect about a 5% - 2% = 3% annual decline in the $JA:US rate going forward. Considering the $JA:US rate has averaged a roughly 11% annual decline since 1989, this should hardly be an unmanageable situation. Developing a forward foreign exchange market as the PSOJ is urging would certainly help. But it is high time the Jamaican public was educated about the expected currency consequences of inflation targeting.

This country has enough real problems, having the world's second highest murder rate being the main one. So we need to stop wasting time and energy on the imaginary issue of exchange rate volatility, when our currency movements are on the whole very much in line with accepted economic theory. As long as we keep inflation under control, we have nothing to fear exchange rate wise, but fear itself. Kob.chang@fontanapharmacy.com