Columns By Category

Popular Articles

- THE REALITY OF TACKY AND SAM SHARPE

- PLEASE DON’T BETRAY US AGAIN POLITICIANS

- CRY, MY MURDEROUS COUNTRY

- MODERNIZING THE PNP: VERSION.2020

- IS THE EXCHANGE RATE ON TARGET OR IS IT A WHOPPER?

- CARICOM: BEACON OF DEMOCRACY OR COWARDLY DISGRACE?

- DEMOCRACY PREVAILS IN THE UNITED STATES

- THE CRIME STATISTICS SPEAK FOR THEMSELVES

- PETROJAM, OIL PRICES, AND THE $7 TAX

- Kevin O'Brien Chang | Brains, not brutality – smart(phone) crime fighting

- TERRORISM IN JAMAICA

- STOP CURRENCY CRISIS TALK

- 'CASTIGATED KD' AND THE 9 YEAR WONDER

- GET PAST MERE TALK ON DONS AND GARRISONS

- LOW VOTER TURNOUT MYTHS AND ELECTION PREDICTIONS

- HOW GREAT CAN BROGAD BE?

- PNP WAS SOCIALIST FROM THE START

- AN AGE AND GENDER RE-ALIGNMENT ELECTION?

- Most influential Jamaican of 2010-2019?

- NO GAYLE, NO RUSSELL, NO TALLAWAHS

IS THE EXCHANGE RATE ON TARGET OR IS IT A WHOPPER?

- 8-3-2018

- Categorized in: 2018 Articles, Yearly ARCHIVES

The Jamaican Dollar has recently reached its lowest ever level against its US counterpart, slipping below the $134 mark for the first time ever. Is this a cause for concern?

The standard economic tool for valuing a currency is the Purchasing Power Parity theory. This states that exchange rates between two currencies are in equilibrium when their purchasing power is the same in both countries. So the J$ rate should equal the price of a fixed basket of goods and services in Jamaica divided by the price in the USA.

If two currencies begin in equilibrium, the rate of appreciation of one against the other should equal the difference in inflation rates between the two countries. For example, if Jamaica’s inflation rate is 3% and the US’s is 1%, the J$ should depreciate against the US$ by 2% per year.

PPP does not always hold in the short run, as factors like expectations of growth, inflation and interest rates can drive exchange rates in the near term. But the economic forces behind PPP will eventually equalize the purchasing power of currencies, though this can take many years. A typical time horizon is 4-10 years.

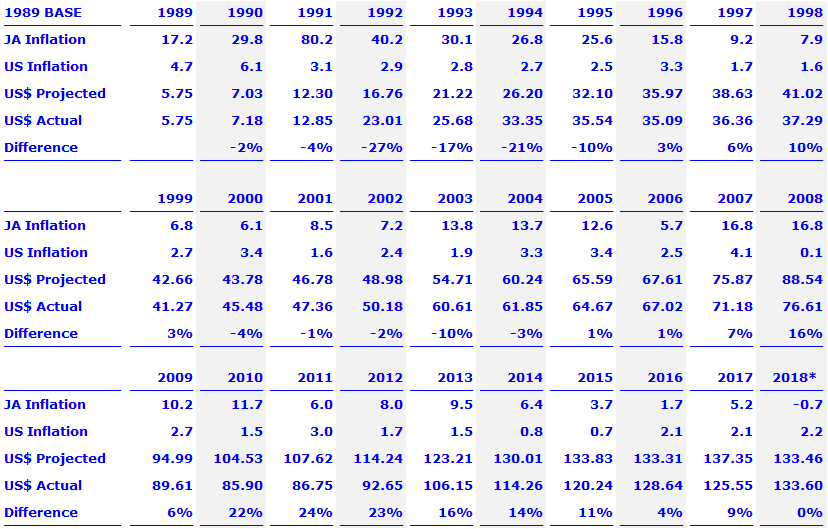

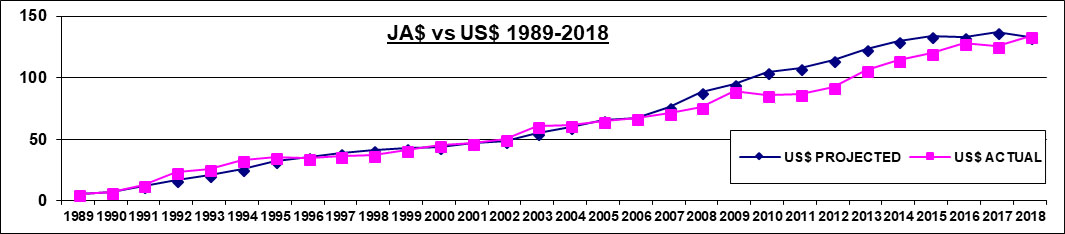

Below are a table and chart showing annual PPP projections of the J$ rate versus actual rates using 1989 as the base year.

* US and JA Inflation figures as of May 2018.

So if the J$ was correctly valued in 1989, its correct PPP value against the US$ should now be 133.46. The Bank of Jamaica selling rate at the close of July 25 was 133.60. Meaning the current Jamaican to US Dollar rate is almost exactly what Purchasing Power Parity would predict.

Now these figures show the J$ and US$ in isolation. The Economist magazine’s ‘Big Mac’ hamburger index gives an international view. To quote

“… in the long run, exchange rates should move toward rates that equalise the prices of an identical basket of goods and services in any two countries. To put it simply: one US dollar should buy the same everywhere. Our basket is a McDonald's Big Mac, produced locally to roughly the same recipe in 118 countries. The Big Mac PPP is the exchange rate that would leave burgers costing the same as in America. Comparing the PPP with the actual rate is one test of whether a currency is undervalued or overvalued.”

In her book ‘The Big Mac Index’ Li Lian Ong of the IMF says it has been surprisingly accurate in tracking exchange rates in the long term.

There are no McDonald’s and Big Macs in Jamaica. But we have Burger Kings and Whoppers. The current price for a Whopper sandwich in Jamaica is JA$545. The current average price for a Whopper in the US is US$4.19. https://www.fastfoodmenuprices.com/burger-king-prices/

Dividing 545 by 4.19 equals 130.07. Which is 2.6% less than the July 25 closing BOJ rate of $133.60.

So both by Purchasing Power Parity and the Big Mac/Whopper Index, the Jamaican Dollar is pretty much where it should be against the US Dollar. An objective outsider view might be that as our foreign exchange market has matured, it seems that through the forces of demand and supply, our $JA/US exchange has reached a roughly correct parity without any undue economic upheavals taking place.

Anyone looking at this data has to ask why. Why did the $JA/US rate go from 5.50 in 1989 to 134 in 2017? The answer of course is economic mismanagement - borrow and spend policies that inevitably led to massive debt, runaway inflation and a crumbling exchange rate. Yet this did not start in 1989, and indeed became the norm for Jamaica after 1973. (Sources: BOJ, http://www.factfish.com/statistic-country/jamaica/inflation rate)

|

Year |

Inflation |

$JA/US |

|

1962 |

1.4 |

|

|

1963 |

1.8 |

|

|

1964 |

2 |

|

|

1965 |

2.6 |

|

|

1966 |

1.9 |

|

|

1967 |

3 |

|

|

1968 |

5.9 |

|

|

1969 |

6.3 |

|

|

1970 |

14.7 |

|

|

1971 |

5.3 |

0.77 |

|

1972 |

5.4 |

0.77 |

|

1973 |

17.7 |

0.91 |

|

1974 |

27.2 |

0.91 |

|

1975 |

17.4 |

0.91 |

|

1976 |

9.8 |

0.91 |

|

1977 |

11.2 |

0.91 |

|

1978 |

34.9 |

1.05 |

|

1979 |

29.1 |

1.69 |

|

1980 |

27.3 |

1.78 |

|

1981 |

12.7 |

1.78 |

|

1982 |

6.5 |

1.78 |

|

1983 |

11.6 |

3.3 |

|

1984 |

27.8 |

4.95 |

|

1985 |

25.7 |

5.5 |

|

1986 |

15.1 |

5.5 |

|

1987 |

6.7 |

5.5 |

|

1988 |

8.3 |

5.5 |

From 1962 to 1971 inflation averaged 4.6%. Fromm 1973 to 1980 it averaged 21.8%. From 1980 to 1988 it averaged 14.3%. Only artificial measures prevented more drastic devaluation than $JA/US 0.77 to 5.50. For instance there is no way a real exchange rate could have remained stable from 1985 to 1988 given cumulative inflation of 56%. It is instructive that 2015, 2016, 2017 were the first three consecutive years of 5% and under inflation since 1966, 1967 and 1968.

Not since the days of Busta and Norman has Jamaica experienced the fiscal discipline of the past 4 or so years or so. Full credit must go to the Simpson-Miller/Phillips and the Holness/Shaw/Clark regimes. But let us not rest on our laurels and ignore the terrible price of debt, low growth and under-development we have paid for the economic profligacy of the intervening 50 years or so. We must never go back to the bad old days. Those who forget the past are condemned to repeat it.